The burgeoning world of competitive gaming, often referred to as esports, is a vibrant landscape of innovation, thrilling competition, and significant financial investment. With events like the Esports World Cup showcasing dozens of titles, it’s easy to focus solely on the rising stars. Yet, for every success story, there are cautionary tales of games that once held immense promise, only to see their professional scenes wither and fade. This exploration delves into the fascinating, if somewhat somber, narratives of five such disciplines that ambitiously sought a place in the esports pantheon but ultimately fell from grace.

We’re not discussing games like Valve’s *Artifact*, which, despite its initial esports aspirations, never truly took meaningful steps beyond the drawing board. As the saying goes, what is already dead cannot truly die again. Nor are we delving into ancient history, such as the *Need for Speed* series from the early World Cyber Games – those are artifacts of a bygone era, indeed.

Paladins: The Budget Challenger That Couldn`t Keep Pace

Emerging shortly after Blizzard`s *Overwatch*, Hi-Rez Studios` *Paladins* entered the scene as a distinctly similar hero shooter. It featured the familiar roles of support, tank, damage, and flanker, along with objective-based gameplay and cartoonish fantasy aesthetics. While often dubbed a “budget clone,” *Paladins* carved out its own niche with simpler graphics, unique perk mechanics, and, notably, mountable horses.

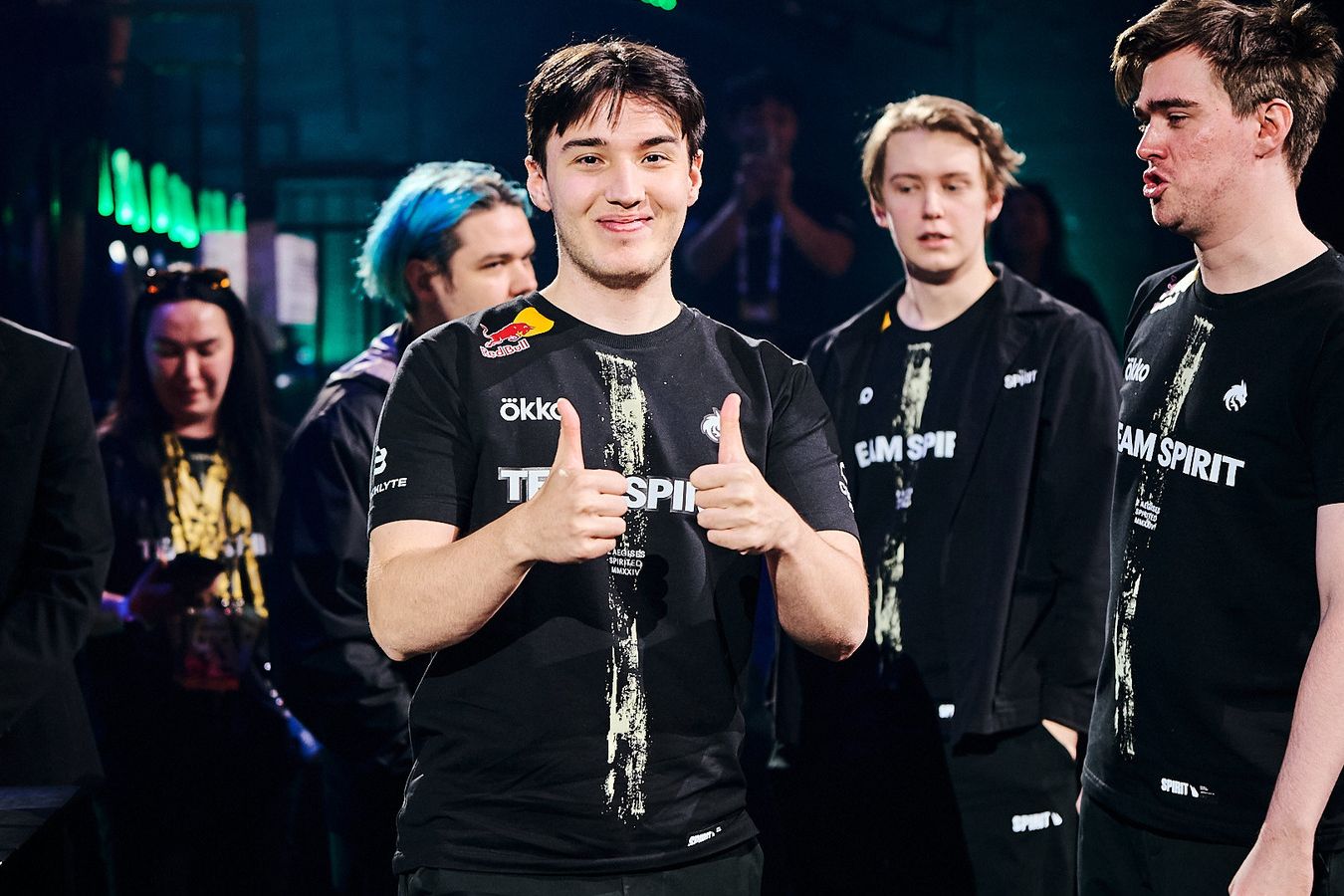

Initially, *Paladins* showcased considerable esports potential. Tournaments began in 2017, attracting major organizations like Virtus.pro, NAVI, NiP, and Team Envy. Hi-Rez even hosted substantial LAN events, including a 2019 World Championship in Atlanta with a respectable $300,000 prize pool. The ecosystem was robust: dedicated broadcast studios, regional qualifiers, professional teams – everything seemingly in place.

However, *Paladins* shared a critical flaw with its more polished counterpart: spectator appeal. Both games proved notoriously challenging for observers to broadcast effectively, often leading to a disorienting, even monotonous, viewing experience. While *Overwatch* leveraged a colossal marketing budget and the grandeur of the Overwatch League to compensate, *Paladins*, lacking comparable resources, simply couldn`t overcome this hurdle. Peak viewership rarely surpassed 100,000. In early 2021, Hi-Rez ceased official esports support, and by 2025, announced the discontinuation of new content for the game itself. The servers may linger, but the professional dream is long gone.

GWENT: A Card Game`s Curious Case of Decline

Born from the beloved mini-game in *The Witcher 3*, *GWENT* by CD Projekt RED was poised for a unique esports journey, reminiscent of *Dota 2*`s evolution from a *Warcraft III* mod. Official tournaments commenced during its beta phase in 2017, a time when its mechanics and visuals differed significantly from its eventual official release.

CD Projekt RED`s commitment to esports was evident. They hosted events in truly distinctive locations – grand castles and even subterranean salt mines – seeking to perfectly align the tournament setting with the game`s rich lore. Alongside these $100,000 LANs (one even featured *The International* champion Peter “ppd” Dager), regular online leagues offered up to $25,000. A full professional season culminated in a $250,000 World Championship.

Despite this artistic and dedicated approach, *GWENT*`s esports audience remained elusive, peaking at a mere 50,000 viewers. This is a common Achilles` heel for many collectible card games (CCGs) – their inherent complexity often translates poorly to a broad spectator experience. Furthermore, *GWENT*`s official 2018 release brought significant mechanical changes, making the game more complex and altering its balance. While visually appealing, these changes alienated a segment of its player base. CD Projekt RED continued support for several more years, but the grand, quirky LANs vanished, and prize pools dwindled. The final official event, a modest World Championship, occurred in 2023, after which the game was fully handed over to the community, marking the end of its professional era.

Heroes of the Storm: Blizzard`s Unprofitable Masterpiece

Perhaps the most prominent example of a fallen giant, *Heroes of the Storm* (HotS) was Blizzard`s ambitious entry into the MOBA genre, featuring characters from across their iconic universes. It aimed not merely to replicate the success of *Dota 2* or *League of Legends* but to revolutionize the genre by simplifying mechanics and emphasizing team play.

HotS initially found a dedicated audience, fostering a vibrant esports scene. The first World Championship took place in 2015, attracting top-tier organizations like Cloud9, NAVI, MVP, Fnatic, and Dignitas. The professional season was robust, with numerous transitional events offering prize pools ranging from $100,000 to $400,000. The annual BlizzCon World Championship boasted a staggering $1 million prize.

From all appearances, HotS esports was an S-tier discipline: excellent production, engaged fans, and renowned teams. Blizzard even established a collegiate league in the US, mirroring traditional sports models. Yet, beneath this glossy exterior, rumors of HotS`s financial underperformance began to circulate. The game entered a crowded market late, struggling to compete with established titans, and Blizzard grappled with an effective monetization model. In a shocking announcement barely a month after the 2018 World Championship concluded, Blizzard declared the immediate cessation of HotS esports support. It wasn`t a dying patient; it was an active, functional scene deemed simply “unprofitable.” While community-funded events sporadically emerged later, these were mere echoes of a once-thriving competitive landscape. By 2022, Blizzard formally ended new content development for HotS itself.

Wild Rift: Mobile Ambitions Drowned by Incumbents

Riot Games, the titan behind *League of Legends*, brought its flagship MOBA to mobile platforms with *Wild Rift*. On paper, this seemed like an unstoppable force: the most popular MOBA on the most accessible platform, developed by an industry leader. What could possibly go wrong?

Riot`s crucial misstep was timing. *Wild Rift* launched in late 2020, by which point established mobile MOBA giants like *Honor of Kings* and *Mobile Legends: Bang Bang* were celebrating their fifth anniversaries. Capturing a significant audience slice and rapidly building an esports player base proved an immense challenge against such entrenched competition.

Leveraging their vast esports experience, Riot held a Tier-1 championship a year after launch, offering $500,000 and attracting big names like Team Secret and TSM. Still, viewership was modest, peaking at only 62,000. A year later, Riot upped the ante for the first full World Championship, deploying their signature marketing arsenal: cinematics, music videos, elaborate stage designs in Singapore, and star-studded promotional campaigns, alongside a two-million-dollar prize pool. It seemed destined for *League of Legends*-level success.

The outcome, however, was catastrophic. Peak viewership for this grand event plummeted to 54,000, not even in the finals. For context, *Honor of Kings* boasted nearly 400,000 viewers, and *MLBB* routinely topped several million. Months later, Riot significantly scaled back Wild Rift`s esports support globally, preserving only Asian leagues, which now operate on a much smaller scale, largely unnoticed outside their core regions. While Riot experiments with “Wild Rounds: SMASH” – entertainment events featuring content creators and pros – it’s a far cry from the robust professional esports circuit once envisioned.

Auto Chess: The Auto Battler Craze That Crashed

Remember the unprecedented “chess boom” of 2019? It was ignited by *Dota Auto Chess*, a custom map that propelled *Dota 2*`s average online player count by nearly 25% in mere months, giving birth to an entirely new genre: auto battlers. This surge led to official iterations like Valve`s *Dota Underlords*, Riot Games` *Teamfight Tactics*, and, crucially, a standalone release from the original creators – simply titled *Auto Chess*.

Released just months after the custom map`s meteoric rise, *Auto Chess* (supported by Dragonest) appeared to be at the vanguard of a new esports wave. The initial interest was phenomenal; *Dota Auto Chess* alone garnered 7 million players and 300,000 average concurrent users within a few months.

Naturally, Drodo and Dragonest believed their standalone version would inherit this success. Early competitive events, featuring modest $5,000-$10,000 prize pools, began during the custom map`s popularity. The standalone *Auto Chess* then went all-in, announcing a $1 million World Championship – a prize pool previously reserved for only the industry`s absolute top disciplines.

The 32-player tournament took place in Shanghai, featuring international contenders. However, official broadcasts were primarily for the Chinese audience, making global viewership metrics hard to ascertain. The aftermath, though, was telling: after the *Auto Chess Invitational 2019*, the creators` enthusiasm for significant esports investment waned. Smaller *Auto Chess* events continued, but the grand world championships and million-dollar prize pools became a relic of the past. The last notable international tournament occurred in 2021. More broadly, the auto battler hype itself quickly subsided, affecting all titles in the genre. For *Auto Chess*, even its official website hasn`t seen news updates since 2023.

A curious footnote: One former Team Liquid player, who specialized in *Artifact*, found himself competing in *Auto Chess*. Some might say he had a peculiar knack for joining games destined for early retirement. What a ride!

Lessons From the Esports Graveyard

The stories of *Paladins*, *GWENT*, *Heroes of the Storm*, *Wild Rift*, and *Auto Chess* offer profound insights into the volatility of the esports industry. They underscore that even with substantial investment, passionate developers, and established competitive structures, success is never guaranteed. Key takeaways include:

- Spectator Appeal is Paramount: Games that are difficult or visually unengaging to watch, regardless of how fun they are to play, struggle to build a large audience.

- Timing and Market Saturation: Entering a crowded genre late, especially against well-established behemoths, poses a formidable challenge.

- Sustainable Monetization: Esports requires a healthy underlying game economy. If the game itself isn`t financially viable, its competitive scene is always at risk.

- Developer Commitment: Sudden shifts in developer priorities or abrupt withdrawal of support can instantly dismantle a thriving esports scene.

- Genre Longevity: Hype cycles can be intense but fleeting. Genres that lack fundamental, enduring appeal may see rapid decline.

As the esports ecosystem continues to evolve, these cautionary tales serve as invaluable lessons. The graveyard of ambition is a stark reminder that even the grandest visions can crumble without a comprehensive understanding of market dynamics, audience engagement, and long-term sustainability. The future of esports will undoubtedly be shaped by those who learn from the past, ensuring that new disciplines are built not just on passion, but on solid strategic ground.